Building BKR has stretched us both professionally and personally. For Isaac, the shift meant evolving from investing at a personal scale to multiplying that role by ten, navigating the added weight of institutional structure and broader geographic coverage. It was also meaningful for him to be able to use institutional capital to solve for others the very challenges he once faced as an entrepreneur.

For me, the stretch has been about layering my investment expertise with the realities of running a lean, entrepreneurial operation: balancing investor relations, administrative demands, founder support and ecosystem activities while building something from the ground up with a small team.

The growth has not been just ours. We have watched our founders grow from early-stage dreamers into recognised leaders. We have seen entrepreneurs who once thought VC was not for them realise it could be. We have seen small shifts in spaces that once ignored Black presence now reflect it proudly. Those moments make the grind worthwhile.

The Legacy We’re Building

When we launched BKR Capital in 2021, we stepped into history as the first Black-led institutional venture capital firm in Canada. That milestone was important, for representation and for founders who had long been overlooked or misunderstood.

Our mission has always been to create an ecosystem where Black entrepreneurs are seen but backed, cultural nuance is understood as an asset, and where the next generation of innovators can build on firmer ground than we had.

Seeing Value Others Miss

Traditional VC is built around a narrow mould of founder and business. Black founders often do not fit that mould, not because they lack ambition. Their journeys and networks are shaped by different experiences. At BKR, we strip away the bias that clouds early-stage investing.

When a pitch is about remittances, we already understand its importance from lived experience. If it is personal care tailored to the Black community, we instantly see the opportunity. That cultural alignment lets us spot potential where others hesitate.

Many of our founders are also creating inclusive products that serve everyone. They think global from day one, forming partnerships in the Caribbean and Africa while building in Canada. Where some investors shy away from that ambition, we welcome it and use our networks to help them move faster.

Betting on People, Not Just Ideas

We invest very early, so our focus is on people. In venture, ideas are cheap; execution is key. Over the last few years, we have reviewed more than 1,800 pitch decks, many with brilliant ideas. The real question is always: Is this the right team to execute?

We look for hunger, founders determined to succeed with no fallback plan. We look for aura, leaders who attract talent even without deep pockets. And we look for unfair advantage, the expertise or perspective that makes them uniquely suited to solve their problem.

Our thematic focus is clear: the future of work and the future of living, through an inclusive lens. From healthcare to consumer tech to industrial software, we back founders building solutions that transform how people live, work, and thrive.

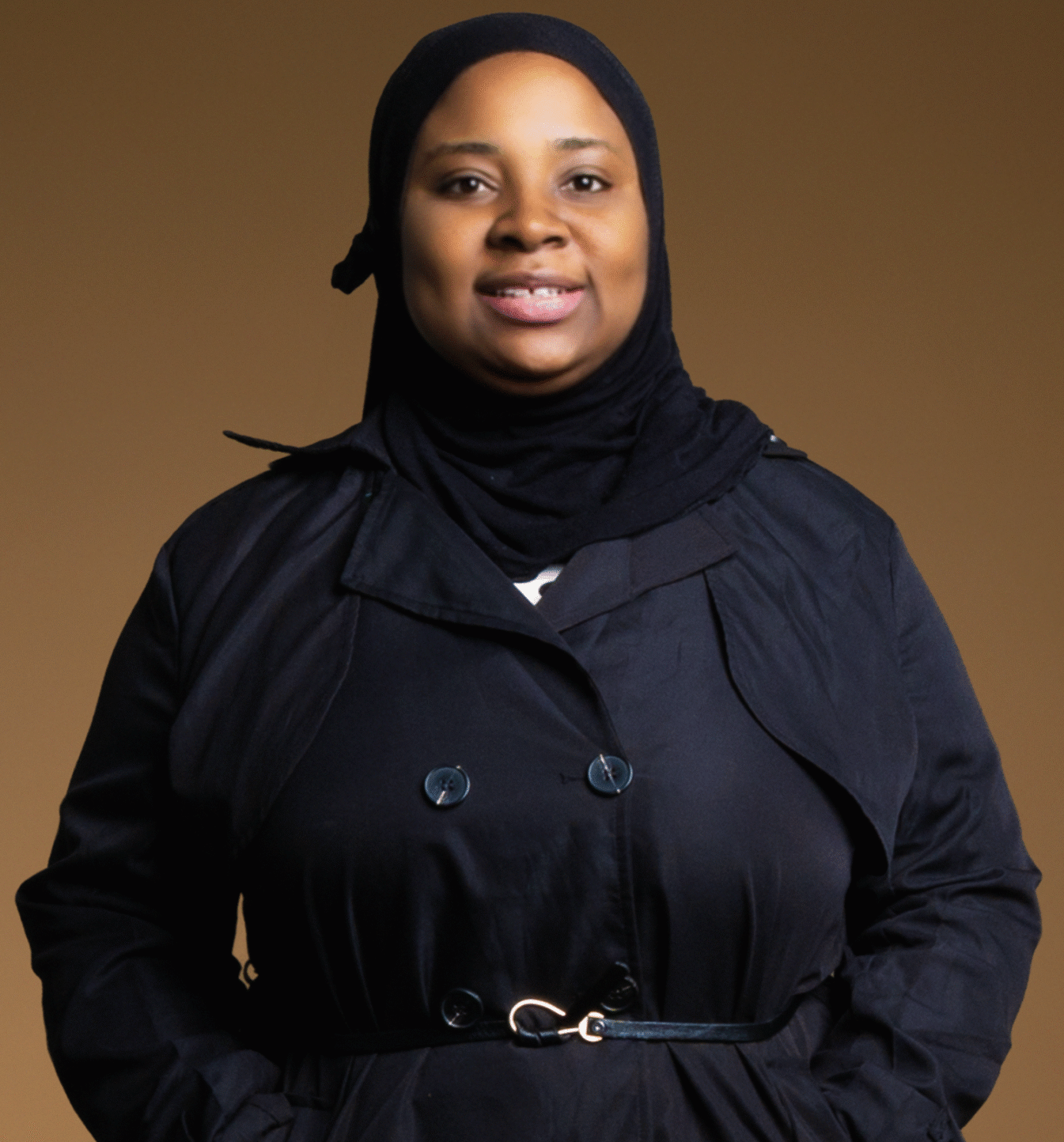

Two Lenses, One Vision

One of our strengths as a team is complementarity. Isaac brings over two decades of entrepreneurship, while I (Lise) offer over 15 years of experience in institutional investing. Together, we merge the scrappy builder’s mindset with the structured investor’s lens.

Our geographic and cultural differences add even more depth. I am a Francophone from Quebec with East African roots, and Isaac is from Ontario with West African heritage. These varied experiences shape how we see founders, evaluate risk, and build bridges. What unites us is a shared mission to shift the ecosystem for the long term and create lasting change.

Unlocking Doors, Building Networks

The biggest challenges Black founders face in Canada and North America boil down to two things: capital and networks. Generationally, we have not always had access to the relationships that unlock contracts, funding, and mentorship. Without those, scaling becomes harder.

That is why institutional backing was critical for us. With it, we open doors to contracts, co-investors, and credibility that founders might not otherwise access. Almost every time we invest, we syndicate. On average, our capital attracts five times more from our networks. That multiplier effect does not just grow businesses; it grows the entire ecosystem.

Redefining Success

There is a burden Black founders carry that others do not. When a non-Black founder fails, the failure is personal. But when a Black founder stumbles, too often it is seen as reflective of the whole community. That is unfair, but it is reality.

Our way of pushing back is by building blueprints of success. We are intentional about creating and amplifying stories of founders who are scaling, exiting, and reinvesting. And importantly, we do not operate in isolation. From day one, we chose collaboration with mainstream institutions. That is how we shift perception, by proving that investing in Black founders is not charity. It is smart business.

Not Just One Sector

There is a stereotype that Black founders only build for Black communities or that they are mostly in creative industries. While we certainly celebrate our creative leaders, the reality is broader. We see numerous companies in deep tech, critical minerals, healthcare, HR, and more.

What is unique about Black founders is not the sector, but the lens. They tend to build with inclusivity in mind, products that work for everyone, designed from perspectives that prevent leaving money on the table. And many of our founders, being immigrants or first-generation Canadians, bring global insights that give them an edge in untapped markets.

Shaping the Future

What does success look like for us in the next five to ten years? First, returns. We must deliver for our LPs and show unarguably that Black founders are a worthy and profitable bet. Beyond that, success is when the founders we backed become role models, reinvesting in the next generation.

We want to see Black founders become LPs in funds or in startups, building a cycle of reinvestment and wealth creation. We want institutions that once ignored our community to realise they are missing opportunities if they do not allocate capital here. We want to see the ecosystem shift in Canada and the world, from the proof that both our Fund I and our newly launched Fund II are helping create!