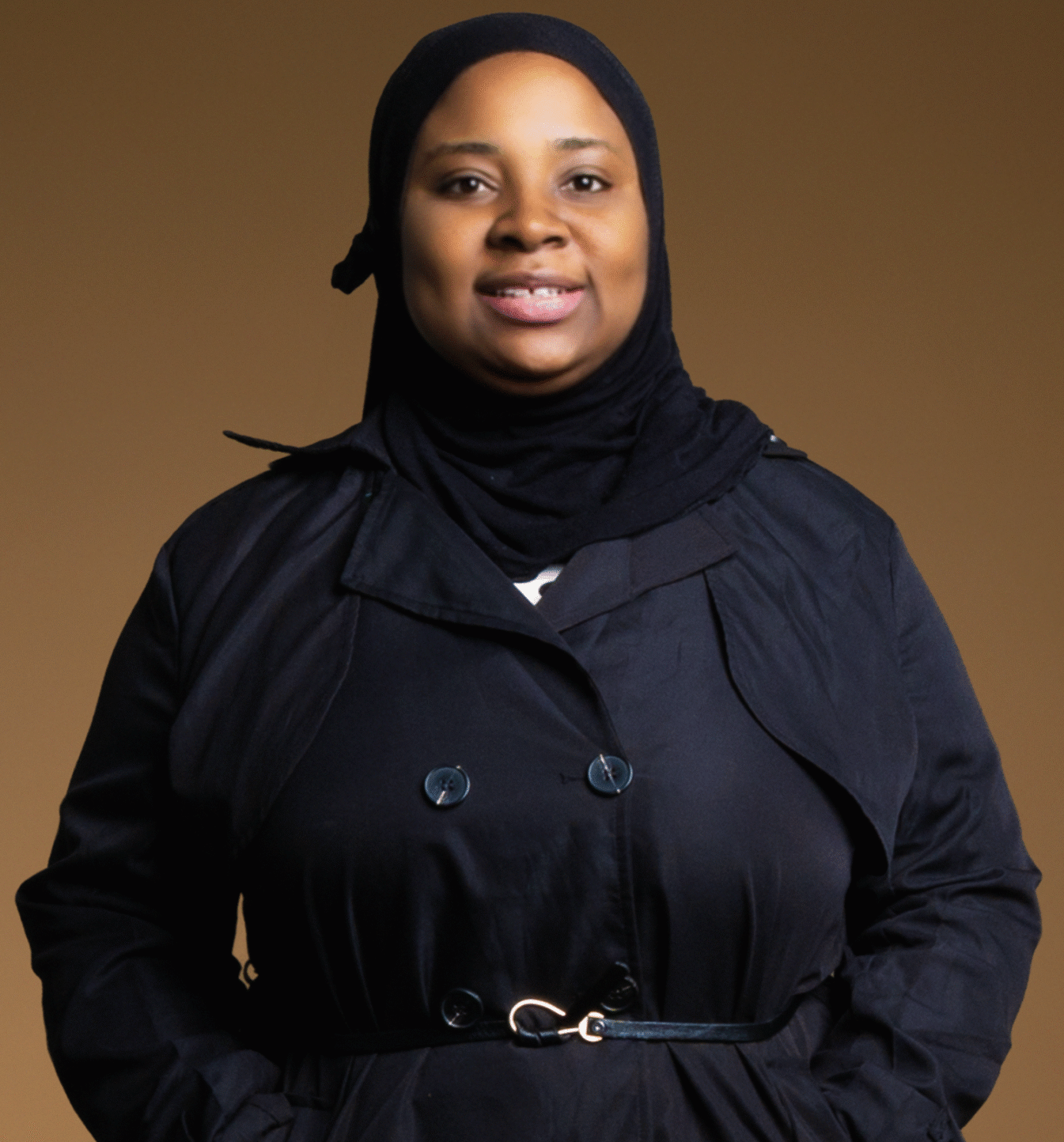

My journey toward financial prosperity started in my early career in banking and finance. I quickly realized that wealth wasn’t just about accumulating money; it was about building a stable foundation for my future and positively impacting my community. This realization led me to ask myself, “What are my long-term goals, and how can I align my financial decisions with my values?” By answering these questions, I set clear personal goals that matched my ambitions and the impact I wanted to make. With these goals in mind, I needed to understand the tools and concepts to help me achieve them.

Understanding Investment Basics

One of the first steps in my financial journey was understanding the basics of investing. Imagine you’re at a farmers market. Stocks are like buying a piece of a fruit stand — you benefit when it sells more fruit and suffer when it doesn’t. On the other hand, bonds are like lending money to the fruit stand owner who pays you back with interest. Mutual funds are like a group of friends pooling their money to buy a variety of stands, spreading out their risk and potential reward. Simplifying these concepts makes investment more approachable and less intimidating.

Understanding these basic investment concepts is crucial because they form the foundation of a solid financial strategy. When you know what stocks, bonds, and mutual funds are, you can start making informed decisions about where to put your money. This knowledge also helps you understand the risks involved in investing. During the past few decades, we witnessed significant financial crises like the 2008 meltdown and the 2020 pandemic’s economic shutdown. Both events were challenging for investors, but a recovery followed each downturn, showing the market’s resilience. To new investors, understanding this history is crucial. It teaches that while the investment journey has ups and downs, patience and perseverance often lead to growth.

The Incredible Power of Compound Interest

The principle of compound interest is another key concept to grasp early on. Let’s consider two investors: James starts investing $500 monthly at age 25. Ron has invested $700 monthly since age 35. If both enjoy a yearly interest rate of 10%, by the time they are both 50, James has earned an additional $352,399 just because he started investing earlier.

Even with small amounts, my early start in investing has allowed my portfolio to grow significantly over time, showing the power of starting early.

With a basic understanding of investing, it’s important to recognize that there is no one-size-fits-all approach. In my portfolio, I’ve balanced active and passive investments — actively managing some assets while letting others grow with the market. Understanding your goals and risk tolerance is key to finding your investment style. Reflecting on these can guide your strategy if it aligns with your financial vision.

Manage Risk With Diversification

Diversification is another critical strategy. Throughout my career, I’ve seen some stocks surge while others lag, only to reverse roles later. This unpredictability shows the importance of diversification — spreading investments across different sectors can help manage risks and seize various growth opportunities. My advice? Look at broad market trends, but make sure your portfolio includes a wide range of sectors and asset classes.

While diversification helps manage risk, the market’s ups and downs can test even seasoned investors. I’ve learned to set long-term goals and stick to a set investment strategy to stay focused, avoiding rash decisions based on short-term market movements. Reviewing your portfolio periodically, rather than reacting to every market change, can help keep your long-term objectives in perspective.

Investing in companies with ethical practices can align your portfolio with your values. Evaluating companies based on their social, environmental, and governance (ESG) performance ensures your investments support sustainable and fair practices, mirroring your commitment to societal improvement.

Get Trustworthy Financial Advice

Navigating the investment landscape can be complex, so seeking guidance is wise. Accredited financial advisors offer personalized advice based on your financial situation, goals, and risk tolerance. Alternatively, robo-advisors provide automated, algorithm-driven investment management.

Embracing continuous learning and adaptability has been crucial in my financial journey. The investment landscape constantly changes, and staying informed about market trends, financial products, and strategies helps you adjust your portfolio as needed, keeping it aligned with your evolving goals. My final advice: Be patient, stay informed, and remember that financial prosperity is a marathon, not a sprint.

Creating a stable financial future also involves using available resources effectively. Engage with community programs, attend financial literacy workshops, and take courses to gain the knowledge needed for informed financial decisions. A supportive network of friends, family, or financial mentors who respect your journey can provide encouragement and accountability.

Set Realistic Financial Goals

Setting realistic financial goals is essential for maintaining motivation and making steady progress. Break your goals into smaller, manageable milestones and celebrate your achievements. This approach helps build confidence and keeps you focused on your long-term objectives.

As you progress in your financial journey, consider giving back to the community. Philanthropy and charitable contributions provide a sense of fulfilment and positively impact those around you. By integrating giving into your financial plan, you help others and reinforce your values and the legacy you wish to create. There may also be a tax incentive to those that give to registered charitable foundations and causes which may be an important part of tax planning.

In conclusion, financial prosperity involves understanding and actively managing investments, starting early, diversifying, and staying informed. Addressing practical and emotional aspects of financial well-being, aligning investments with values, and seeking support when needed are vital steps in this journey. The path to financial success is continuous and requires patience, adaptability, and a commitment to ongoing learning.

*Please note that none of the information above is to be interpreted as direct advice. You should see an accredited advisor for your investments, legal, tax planning and financial planning needs.