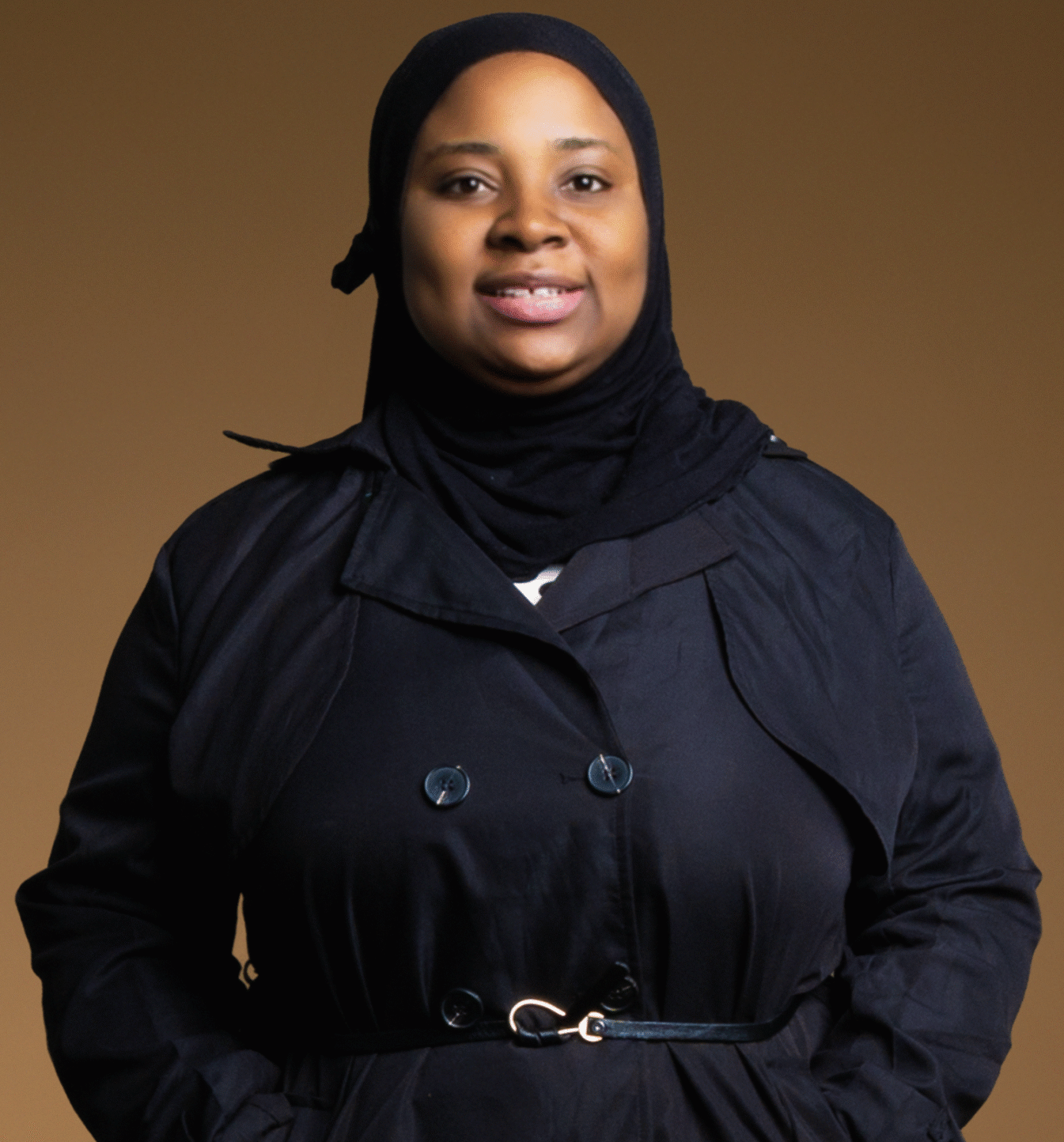

Throughout my career, I have worked in regulated environments. First as a lawyer and then in the capital markets. Both spaces share a central gatekeeping idea: the “fit and proper” person. To be admitted to the bar or registered as a securities dealer, fund manager or investment adviser, regulators must be satisfied you have the qualifications, character and integrity to do the job. That assessment is a threshold matter; after admission, the obligation is to remain fit and proper, showing ongoing competence and integrity.

That expectation brings onboarding and compliance into the same conversation. Onboarding is not an administrative afterthought. It is an early, practical defence against legal and financial exposure. Firms that treat onboarding as gatekeeping design it to verify credentials, screen for regulatory risk, and immerse new hires in the firm’s compliance culture from day one.

Design Onboarding for Rules and Culture

A robust onboarding program delivers two key benefits simultaneously: meeting the technical requirements of securities regulation and aligning with the cultural expectations of compliance. Start with foundational training. New employees must understand ethical standards, reporting lines, conflict rules, and the real consequences of non-compliance.

Training alone will not change behaviour. The “tone from the top” must match training: leadership actions and messaging need to be aligned with the standards they set. Mixed signals undermine everything. To accelerate cultural immersion, assign a senior mentor for upward learning and a peer “buddy” for horizontal guidance. That vertical-and-horizontal learning helps new hires navigate the company’s compliance landscape fast.

Onboarding should not end after orientation. In regulated environments, the first year matters. Regular check-ins provide strategic feedback, uncover blind spots and reinforce continuous improvement. Start onboarding before the first day: verify licences, prepare access controls and set clear expectations in the job offer.

Preventing Costly Legal and Regulatory Missteps

A business is compliant if its people are. Compliance obligations extend to everyone, from the C-suite to administrative support. In many jurisdictions, an administrative support employee of a reporting issuer could face liability for trading on material non-public information. Similarly, every employee shares responsibility to prevent unauthorised access to client data. Firms must also maintain robust cybersecurity, sound accounting practices and accurate records; failures there invite regulatory sanctions and reputational damage.

Onboarding is the time to make those shared obligations explicit. Explain how breaches harm the company and investor confidence across markets. When people understand the stakes, they make better day-to-day choices.

Practical Steps to Make Onboarding a Risk-Management Tool

Treat onboarding as risk-based work that starts before the first day. Practical steps I recommend:

- Risk-based screening: Before making an offer, conduct thorough background checks and verify professional licences and designations. Check for disciplinary actions or regulatory sanctions and assess the level of risk a candidate brings.

- Clear contractual expectations: Include explicit compliance obligations and consequences in job offers. That sets the tone and makes obligations unambiguous.

- Role-specific, tiered training: Avoid one-size-fits-all. Tailor training to the risk profile of the role and the individual; use interactive scenarios so employees practise applying rules to realistic dilemmas. Consider phased learning where new hires work through test cases riddled with complications before handling live files.

- Strategic use of technology: RegTech can automate workflows and track completion. Restrict data access until training is complete and generate alerts for missing compliance steps or suspicious access attempts.

- Shadowing and phased responsibility: Let new hires observe experienced staff, then progress to controlled live work.

- Speak-up culture: From day one, signal that reporting misconduct is expected and protected. Early internal resolution reduces the risk of external reporting and regulatory escalation.

- Leverage co-operation policies: Regulators reward self-reporting and cooperation; entities that disclose and remediate promptly may receive reduced sanctions or other incentives.

Cross-Functional Collaboration

Onboarding should not be left to HR alone. Legal and Compliance must design and deliver parts of the program and remain involved through implementation. Presentations from Legal and Compliance during orientation communicate priority and give new hires a rounded view of the regulatory environment in which they will work. That joint approach reduces gaps and ensures context is not missed.

Navigating Regulated Markets

Many Black-owned businesses are accessing capital markets. Here, the stakes of hiring are higher. Hiring mistakes that might be manageable in small private settings can be catastrophic when public funds are involved. That reality means you must prioritise character and proficiency.

Do not weaken standards for short-term community benefits. Many skilled professionals within the Black community meet high ethical and professional standards; hiring for the community should not mean compromising on compliance. For key roles, consider head-hunters with regulatory expertise to broaden the candidate pool while protecting the business.

The Future of Onboarding

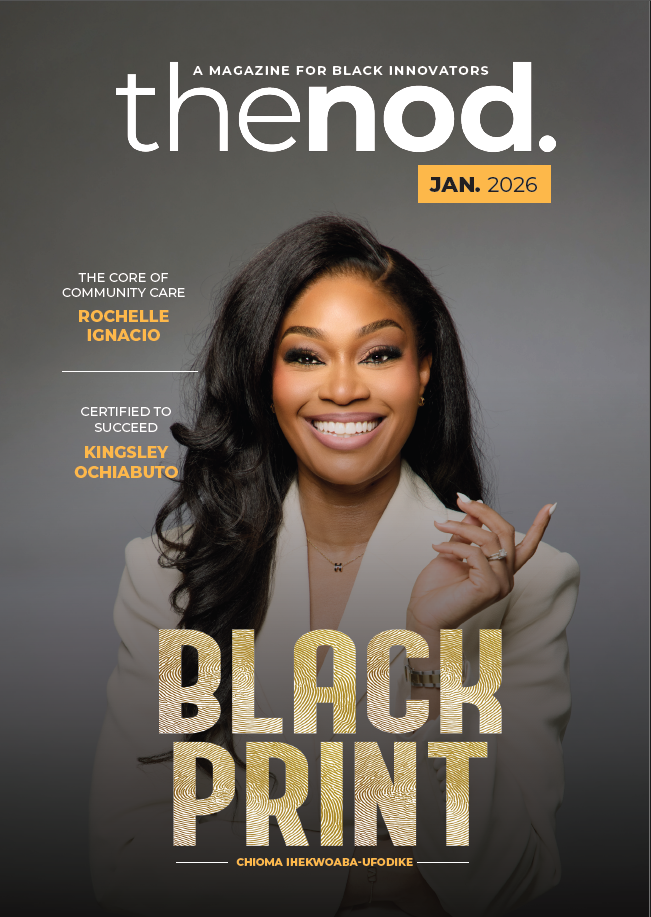

Technology will change onboarding over the next decade. I expect AI-driven risk profiles to customise training, and microlearning modules to replace overwhelming policy packs. VR simulations and gamified learning can make compliance practical, not theoretical. These are not far-fetched; The Nod App is already proving this.

Behavioural analytics will help detect unusual activity before an audit does. Systems can automatically update training as regulations evolve and tailor content to roles. Onboarding will expand to cover data ethics, cybersecurity, AI bias, AI hallucinations and ESG compliance, and it will work across hybrid and remote models.

Onboarding is the first line of defence. When designed from a risk perspective, it does more than inform, shaping behaviour, protecting reputation and safeguarding the licence to operate. Getting onboarding right is an investment in your firm’s longevity and market trust. In regulated industries, operational clarity converts into legal and financial resilience.

The views expressed in this piece are those of the author only and do not necessarily reflect the views of his employer and colleagues.