You’ve finally done it! You’re no longer running a one-person show. You’ve decided to hire help, build a team, and grow your business. With that decision comes a wave of financial and tax responsibilities most entrepreneurs are not fully prepared for.

The truth is, many founders unknowingly walk into a tax minefield when they begin scaling. The right knowledge and systems help you scale smart, staying compliant without losing sleep or money. I’ve seen firsthand how costly it can be to skip this part of the planning process, and I want to help you avoid those pitfalls.

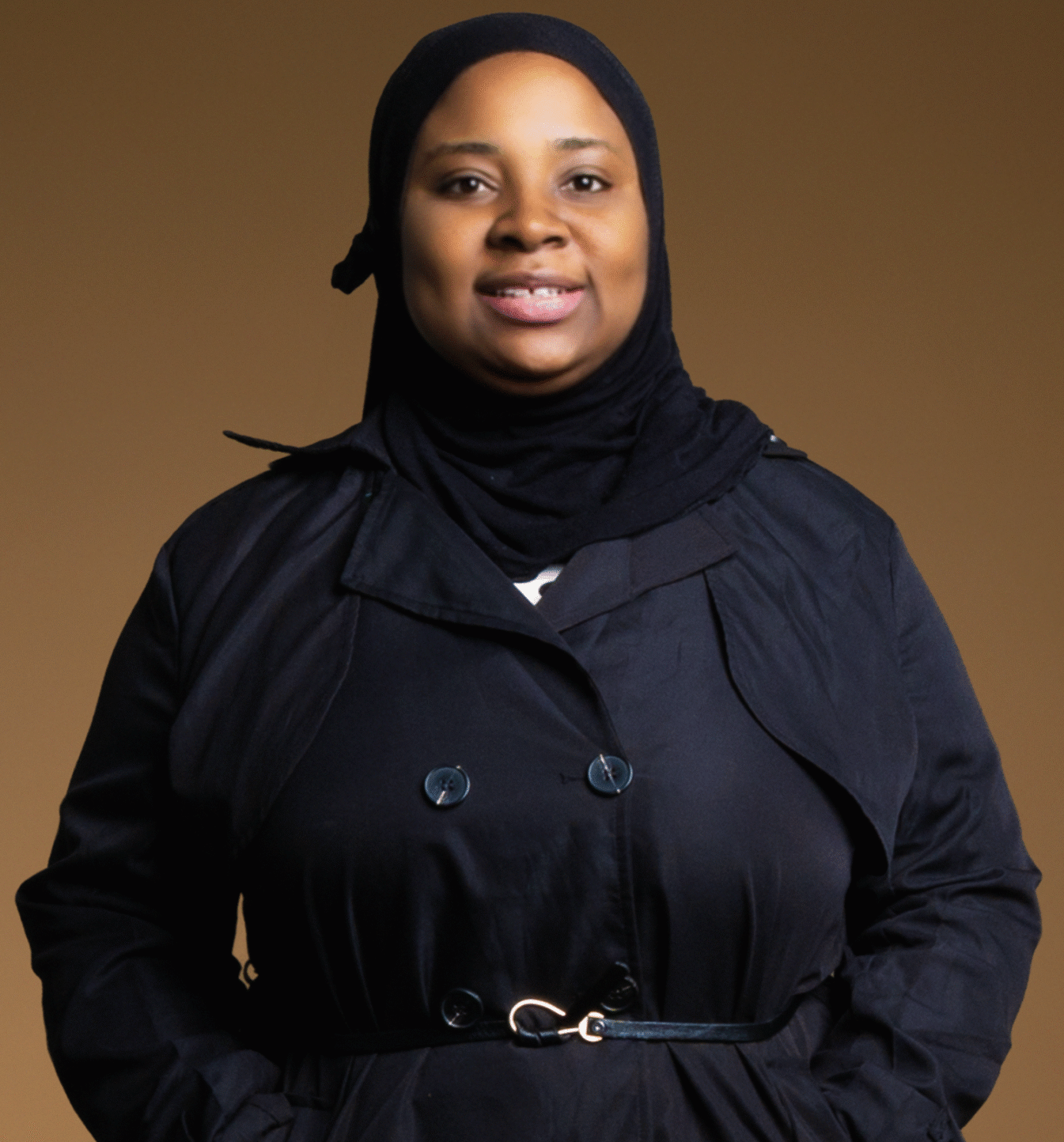

Becoming an employer means stepping into a new world of financial responsibility. It’s a big leap from solo operating to managing a team. As a new employer, I had to navigate everything from payroll taxes to properly classifying workers. Doing this right made all the difference in avoiding costly mistakes.

Understanding Payroll Obligations

As soon as you move from operating alone to hiring others, whether contractors or salaried employees, your tax responsibilities change significantly. Salaried team members trigger payroll taxes like CPP (Canada Pension Plan), EI (Employment Insurance), and income tax. You also become responsible for WCB (Workers’ Compensation Board) premiums.

This means you bear the burden of contributing a portion of those taxes on your employees ‘ behalf. You have to budget for everyone’s taxes, including yours. This shift can be shocking when not adequately planned for, especially during growth spurts.

Avoiding Common Tax Mistakes

One of the biggest missteps I see employers make is failing to plan for payroll-related taxes. Neglecting your share of these costs in the budget leads to financial strain. Add that to a lack of understanding about calculating deductions or filing windows, and it’s easy to fall behind or incur penalties.

To avoid this, I always advise working with a payroll expert, either through payroll software, a third-party provider, or a specialist familiar with your industry. The right advisor helps you stay compliant and accurate.

Employee or Contractor?

Another trap entrepreneurs fall into is misclassifying workers. It can seem easier to label someone a contractor, but that decision comes with major implications. Contractors typically bring their tools, set their schedules, and are responsible for their taxes. Employees rely on you to supply their tools and remit their payroll taxes.

Misclassification can lead to audits and back taxes. The rules vary by industry, so I encourage business owners to seek guidance tailored to their field. Don’t guess, get clarity from a professional who understands the specifics.

Planning for Growth

From my experience, not having a proactive tax plan is one of the biggest blind spots for growing businesses. Too many business owners only think about taxes at year-end. But tax planning should be ongoing. A strong plan helps you legally reduce your tax burden while ensuring compliance.

Another common blind spot is cash flow mismanagement. As your team grows, your financial obligations increase. If your revenue isn’t scaling at the same pace, or if you’re not managing receivables properly, you could face a cash crunch, and that’s a dangerous place to be.

Before bringing on your first employee, evaluate your business structure. Are you operating as a sole proprietor or a corporation? Each has different tax benefits, deductions, and access to credits. Sit with a tax advisor to decide which structure best suits your long-term growth. Industry-specific savings also exist. For example, in the trades, there are tax benefits for supporting employees who are attending school. Knowing these in advance can help you make strategic hiring decisions.

Bookkeeping Systems

Accurate bookkeeping involves staying compliant and reducing risks. When your transactions are properly recorded, you generate reliable financial reports. These reports are essential for calculating taxes, making financial decisions, and demonstrating compliance if you’re ever audited.

Implementing the right systems as your team grows reduces the risk of non-compliance. Automated systems have saved me time and headaches over time. These tools help reduce the risk of error and ensure your obligations are met duly.

Hidden Help: Programs and Incentives

Many government programs offer support as you scale. These include low-cost loans, wage subsidies, financial planning resources, and even race-based or sector-specific incentives.

Explore federal and provincial resources, not-for-profit organizations, and advisory groups like Business Link, Black business associations, and Indigenous entrepreneurship programs. They offer funding, community, mentorship, and strategy.

Evolving Tax Planning Over Time

Your tax planning needs to evolve as your business and personal life change. What worked when you had one employee might not work with ten. What made sense when you had no children might change if you’re now planning for their education. You can’t separate your personal and business finances; they’re intertwined. Keep revisiting your plan.

As you build a team, forecasting cash flow becomes even more important. Payroll is a fixed expense. Missing a pay cycle can damage team trust. Forecasting helps you identify issues like slow receivables or weak pricing before they become crises. With this insight, you can adjust quickly, revise payment terms, review your service rates, or trim unnecessary spending.

The Mindset Shift Every Employer Needs

I believe that effective tax planning and hiring starts with the right perspective. Paying taxes is a signal that your business is making money. Get the right advice, structure your business strategically, and seek to pay less tax legally.

Build a team that grows with you, not one that puts you at risk. And remember: every dollar saved in taxes is a dollar you can reinvest into your people, your systems, and your vision.